Your access to this site has been limited by the site owner

Table of Content

After all, there's usually no legal method to transfer ownership of a mobile home without a certificate of title. What is the significance of this document, and what happens if you don't have it? Here are the most important things to know about mobile home titles before buying or selling one. Once the agency approves the application, it issues the Statement of Ownership. However, the manufactured home's conversion to real property is incomplete until a certified copy of the document is recorded with the county of location.

You must do a separate mobile home title search in order to discover the condition of the mobile home title and to make sure that you are dealing with the correct home. In the state of Texas the process to transfer a mobile home title from one owner to the next is fairly simple and straightforward. Please see the steps and tips below when considering purchasing or reselling a mobile home in the state of Texas. You will need to include a receipt from the Tax Assessor-Collector with your form, which shows that no taxes remain unpaid on the home, and a lien release form from the previous lien holder.

After closing – Transferring ownership

We provide you with complete, accurate, and current mobile home information so you can get it right. If you notice any errors or improvements please contact us immediately at As always, if you have any follow-up questions or concerns never hesitate to reach out or comment below any time. This rule applies to any mobile home that is personal property in the state of Texas. ” the answer is a little more complicated than you might initially think.

However if you are dealing with an individual mobile home located in a pre-existing mobile home park, on somebody’s rented land, in a lot, or somewhere else than please see the information below. It is crucial that you know the condition of the mobile home title prior to closing. For the same exact reason that you do a land title search – you’re going to insure it! Remember, you are actually dealing with two different kinds of titles (land & home), and they’re separate! We are constantly asked how a lien can show up against a mobile home that didn’t show up in the land title search. The answer is – the mobile home title and the land title are separate!

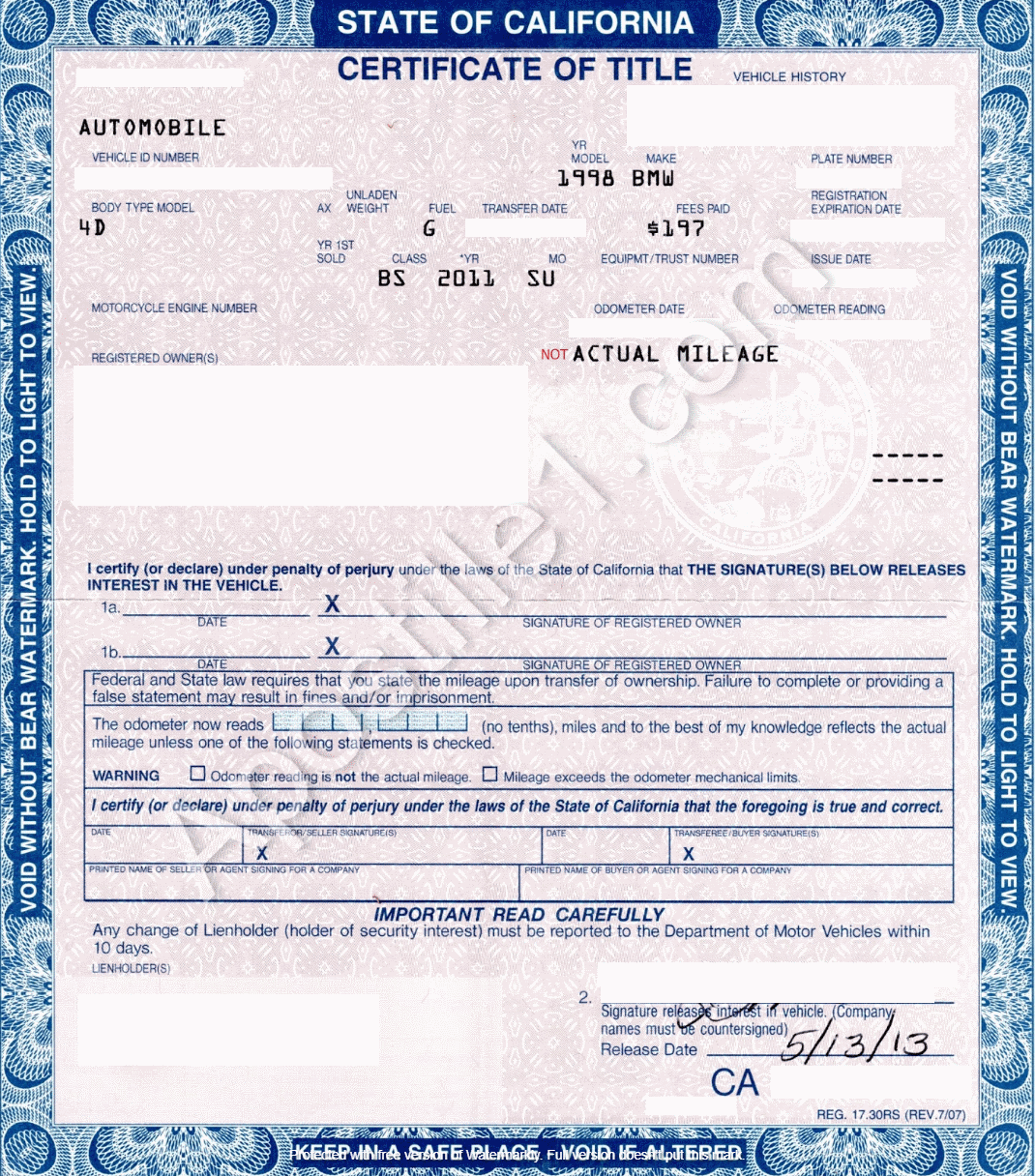

Certificate of Title for Mobile Homes

Allow 2-4 weeks for a new Statement of Ownership and Location to be returned to you via mail. However if you lose this SOL it can be replaced and is not required to resell the mobile home in the future. If the home is going to be moved, you must contact the Texas Department of Motor Vehicles and obtain the required moving permit, which is also submitted alongside your SOL application.

To provide help and clarity to private buyers and private sellers. Below you will find the minimum paperwork needed to transfer a mobile home’s ownership successfully in your state. Transactions and policies regarding Texas mobile homes are regulated by the Texas Department of Housing and Community Affairs , through its Manufactured Housing Division (the “Division”). A closing date is then decided where the seller will move their possessions out of the home. The seller is required to give the buyer all of the required documents, such as the tax lien, Statement of Ownership and Location or the title certificate, and any past inspection reports or repair invoices. A Statement of Ownership application costs $55 to process, and a late application may result in a $100 fee and a delay in its issuance if it is over 60 days late.

How to Transfer Ownership of a Mobile Home in Texas

Before buying a mobile home or transferring ownership in Texas, you want to first check the department records for tax liens, mortgage liens, and current ownership information. You can do this by either searching the Manufactured Home Ownership Records database online or calling the Texas Department of Housing and Community Affairs directly. Texas quit using paper titles to prove ownership of mobile homes in 2003, replacing it with electronic SOLs. The information is kept online in a database for the state to keep track of all mobile homes regardless of their condition or age, mainly for tax purposes. Double check to make sure that the SOL application is filled out, signed, and dated correctly by all parties.

If homeowners wish to return their manufactured home from real property back to personal property, they can do so by applying for a new Statement of Ownership. The TDHCA requires an inspection and lien search to prove there are no liens on the property. Homeowners must also notify their county tax assessor of this change in order to alter how the home's property taxes will be assessed. A mobile home title is transferred in a similar manner as a motor vehicle. Make sure to stay in communication with the buyers to verify that they have mailed all forms to the state in order to change ownership.

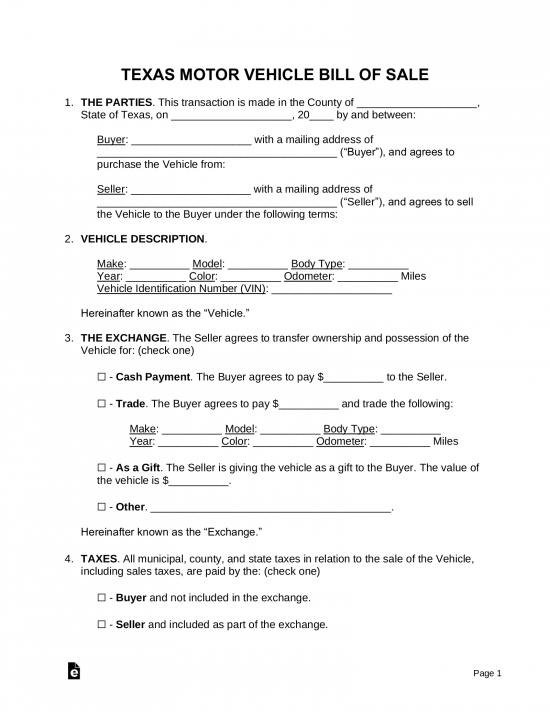

Application for Texas Title and/or Registration (Form-130-U)

A buyer who does not go through an attorney, lender or title company to convert a home to real property should contact the county clerk to ask about fees, requirements and procedures for recording the document. Statement From Tax Assessor-Collectorfrom the local tax collector’s office is needed. Seller should ideally obtain this prior to closing to provide to seller. Seller may pay for taxes and obtain a Tax receipt from the local tax collector’s office. If the manufactured home is affixed to a solid foundation, it is no longer considered personal property in many states.

This page discusses transferring a mobile home’s ownership from a seller to a buyer in the great state of Texas. This is not intended in situations where the land the mobile home sits on is included in the sale. If the land is included in the sale please reach out to a local real estate attorney to help facilitate your closing.

If your state requires a title application, the buyer and, in some situations, both parties must fill it out and sign it. So if you don't have the certificate of title for the manufactured house you own or wish to buy, you're missing out on important information. If an owner of a mobile home chooses to change its use from a business to a residential property, they need to reapply and indicate the change in use. The TDHCA will order an inspection to make sure the home is habitable for residents. After June 2003, the TDHCA replaced the Certificate of Title with a Statement of Ownership and Location , which eventually became known as a Statement of Ownership.

2.) Call your local tax collector’s office to find out back tax amount and total fees to obtain a Tax Receipt for this mobile home. 3.) Close with seller and get all needed forms signed by seller. Pay money to seller, however deduct taxes owned to county tax collector’s office from money to seller. 4.) Now go to local tax collector’s office to pay back taxes and obtain a Tax Receipt. Whether you're considering purchasing a mobile home or selling the one you own, you'll need first to grasp what a mobile home title is.

The next step is ensuring you've signed all the relevant documentation and reviewed every sale step. Remember, signing isn't just transferring the mobile home; it's facilitating all aspects of the transaction. If there's something about the exchange you need more information on, withhold your signature until you can make necessary changes to the agreement.

Because of our extensive knowledge and contacts, we are able to solve and complete 99% of all the transactions that we receive. One of the most typical problems for mobile homes is that the buyer rarely rushes to transfer the title into their name. Years may pass before they finally decide to make the change—and that may only be when it's time to sell the mobile home! So, what should you do if you sell your manufactured home and discover that your name is still missing from the title? Before legally selling the house, you'll need to transfer ownership into your character.

If you own a mobile home or are looking to purchase one in Texas, having a certificate of title is critical to have to prove ownership. When ownership is established, all manufactured homes, house trailers, and mobile homes are issued one certificate of title by the Department of Motor Vehicles because they are considered vehicles and not fixed houses. To make the necessary corrections, owners must provide the identification numbers of the manufactured home, such as a HUD Label, a Texas seal and/or serial number, and information about the corrections required. The TDHCA will review the initial Statement of Ownership application. If the applicant made a mistake, they'll need to fill out a new application and pay the $55 fee a second time for a correct statement. If they did not make a mistake, the TDHCA will correct the statement and send it to the homeowner free of charge.

Title companies often tell us they’re sure the mobile home title is in the seller’s name because the land title shows up in the seller’s name. Believe it, or not, it might not even be the right mobile home. Since 2021 the Texas Department of Housing and Community Affairs has told each Texas county tax collectors’ office they are only allowed to legally charge you for the last 4 years of back personal property taxes.

Comments

Post a Comment